When 2020-era lockdowns hit, the multi-billion-dollar office furniture industry crashed. A year later, MillerKnoll emerged from the rubble as the new industry leader. It’s now the largest company — and also the one with the clearest post-pandemic plan. This 2022 Office Chair Industry Report has the details. Check the top office chair companies — and trends — reshaping the office seating market.

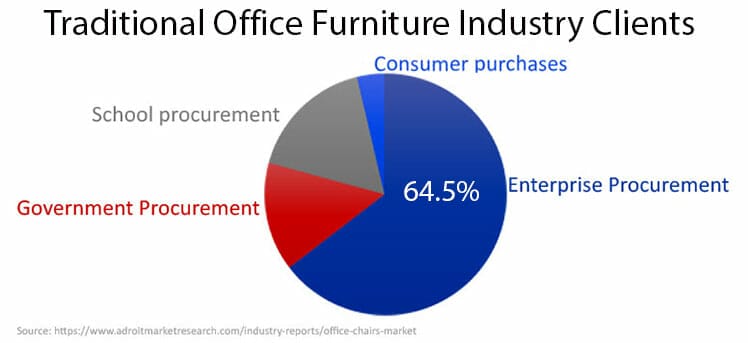

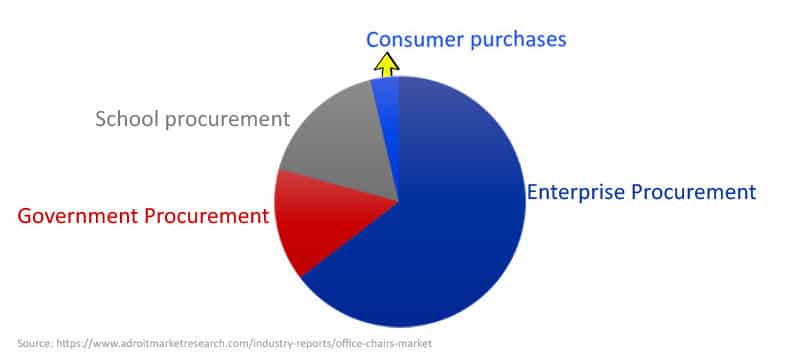

The biggest office furniture companies usually generate billions in annual revenue. Most of that comes from B2B sales to schools, government offices, and corporations.

Over the past several years, Steelcase has consistently ranked #1 (in terms of annual revenue generated). Herman Miller has steadily held the #2 spot.

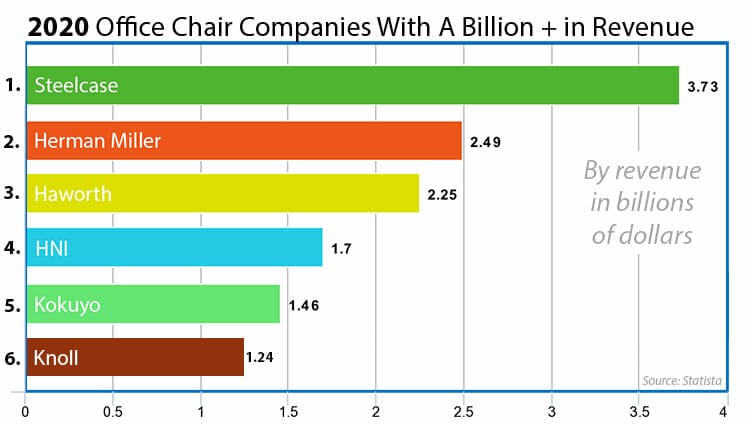

In pre-pandemic 2020, six office furniture companies had generated over a billion in annual revenue. Steelcase and Herman Miller held their usual spots, with the usual stragglers fighting over the scraps.

Business was brisk for all parties. At that time, pundits were predicting robust 6% year-by-year office furniture industry growth.

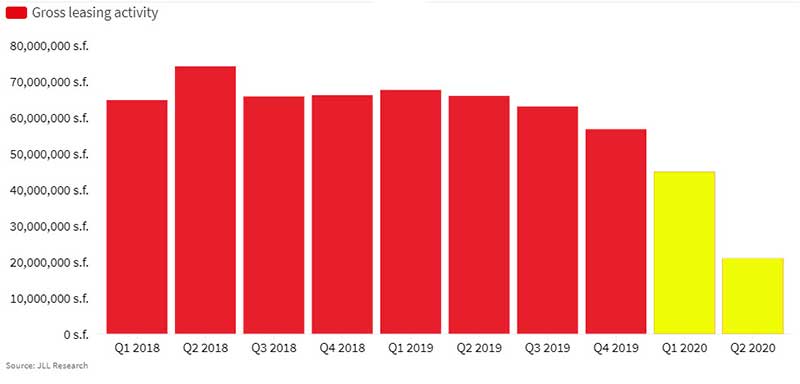

But when lockdowns hit in Q1 2020, office space occupancy crashed. In America, occupancies plummeted by 53%. As offices closed, the demand for corporate furnishings evaporated.

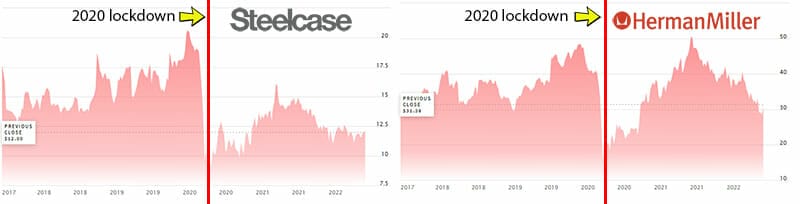

As a result, furniture industry giants saw their revenues crumble. Steelcase shares fell 69% from the 52-week high. Shares of Herman Miller fell over 71%.

Both muddled through slow recoveries as lockdowns eased. Then, in mid-2021, a Herman Miller + Knoll merger dramatically altered the balance of power.

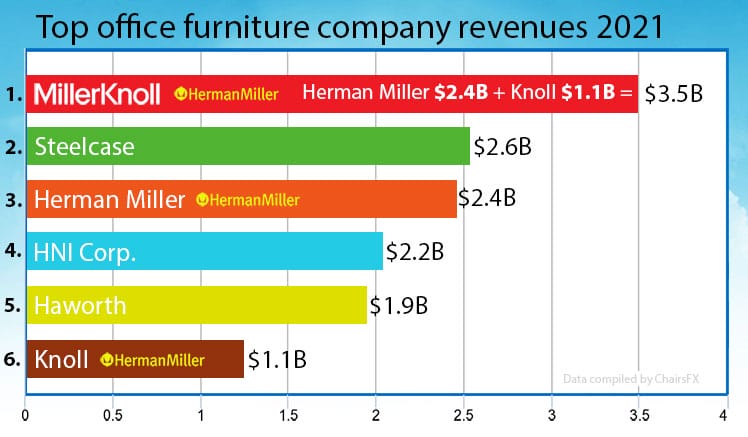

Top Office Furniture Companies Of 2022

The largest office furniture companies of 2022 are the ones that generated the most revenue in 2021. From a stock perspective, the largest are the publicly-traded ones with the biggest market caps.

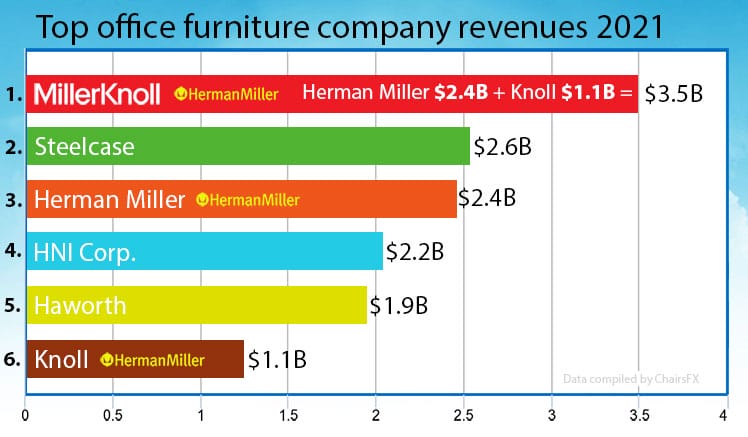

In 2020, Steelcase ranked #1 with $3.1 billion in annual revenue. Michigan-based Herman Miller ranked 2nd with $2.1 billion. New York-based Knoll ranked sixth with $1.24 billion.

In July 2021, the balance of power shifted. Then, 2nd-ranked Herman Miller announced the acquisition of 6th-ranked Knoll(1). Combined, the new company is a juggernaut. MillerKnoll has 19 leading brands, a foothold in 100+ countries, 64 global showrooms, and 50 retail locations.

Per merger details, both Herman Miller and Knoll will continue to operate as independent brands. Meanwhile, MillerKnoll combines the financial, marketing, R&D, and production might of both companies. Based on announced plans, that company’s goal is total industry domination.

As a result, there are still six office furniture companies who earned $1B+ in revenues (in the previous year). Here are the top office furniture manufacturers of 2022:

- MillerKnoll : $3.5 billion

- Steelcase: $2.6 billion

- Herman Miller : $2.4 billion

- HNI Corporation: $2.2 billion

- Haworth: $1.9 billion

- Knoll : $1.1 billion

Herman Miller’s acquisition of Knoll gives them a run of the board. The company now controls the first, third, and sixth-largest office furniture companies in the world!

Top Furniture Companies By Market Cap

Market capitalization refers to how much a company is worth on the stock market. It is calculated as the total market value of all outstanding shares.

Companies are divided according to market cap size. There are large-cap ($10 billion+), mid-cap ($2-$10 billion), and small-cap ($300 million to $2 billion).

Among the top-5 office furniture companies of 2022, only MillerKnoll qualifies as mid-cap. Two others are small-cap. All data comes from NASDAQ.com:

- MillerKnoll: $2.3 billion

- HNI Corporation: $1.6 billion

- Steelcase: $1.3 billion

Key Player Reported 2022 Trends

Each company’s annual report for the 2021 fiscal year cited shipping and inflation as the biggest challenges heading into 2022.

MillerKnoll is the only one with a clear, forward-moving plan. The rest are hoping to ‘ride things out’ and wait for market conditions to normalize. Here’s a summary:

MillerKnoll: New Industry Leader

When the pandemic lockdowns took hold, Herman Miller executives faced a choice. They could ride it out, or ‘take bold action to emerge as an industry leader’. Per Herman Miller’s 2021 Annual report(2), they chose the latter.

“We invested to grow our retail business, continued to modernize our digital technology infrastructure, and accelerated our innovation pipeline.”

Summary of company plans:

- Knoll acquisition: sets up MillerKnoll as the undisputed global seating leader.

- Consumer + B2B Focuses: cater to both business clients and retail consumers.

- Strong gaming chair division: promoted via partnerships with top gaming influencers.

- Local seating stores: mini-shops for grassroots ergonomic evangelism.

- Slick online shopping portal: make it easy for clients and consumers to shop online.

- Rapid gaming chair upgrades: gather player feedback and upgrade chairs accordingly.

- Corporate ergonomic mentoring: teach clients the business benefits of good ergonomics.

MillerKnoll Merger

To position itself as the undisputed leader of corporate office design, Herman Miller acquired Knoll. That deal closed on July 19, 2021. The plan is for all legacy brands (including Herman Miller) to continue operating as distinct brands.

However, the MillerKnoll conglomerate will operate as the largest and most influential office design company in the world.

“As we progressed through the pandemic, we leveraged decades of research… to position ourselves at the forefront of workplace transformation.”

The goal: “Help our customers rethink their own workplaces to shape their cultures and increase productivity.”

Retail Business Skyrockets

For fiscal 2021, Herman Miller (not including Knoll) generated $2.47 Billion in revenue, a decrease of 0.9% over the previous year. Even so, 2021 was a breakout year for its retail business.

That was a key factor “enabling us to overcome the contraction we experienced in the Contract [B2B] business.” Retail sales for the year were $602 million, a 56% jump over the previous year — and the highest ever in company history!

Successful Entry Into The Gaming Market

Fiscal 2021 also saw Herman Miller make a graceful entry into the gaming market. Their mission: “Improve the performance, health, and well-being of gamers, who spend much of their time sitting.”

To kickstart their standing in the market, Herman Miller partnered with Logitech G and TimtheTatman. Beyond Tim, 5 of the top-15 streamers in the world also use Herman Miller products.

With other top names like Ninja, Shroud, Tfue, and xQcOW streaming atop Herman Miller chairs, the company enjoys massive exposure among gamers. Herman Miller plans to capitalize on that.

“We have a compelling strategy to further establish ourselves as a leader in this segment… excited to partner with gamers around the world… designing additional solutions to meet their specific needs.”

Herman Miller Seating Stores

While many brick-and-mortar retailers are closing, Herman Miller has gone in the opposite direction. Herman Miller Seating stores started popping up in Q2 2021. Right now, there are 17 set up in the United States.

Each is a smaller retail space packed with the best Herman Miller chairs. They’re all staffed with seating experts trained to teach you how to use every single chair in the shop.

“All continue to outperform our expectations. They are an important growth vehicle in helping us extend the reach of our brand to new audiences.”

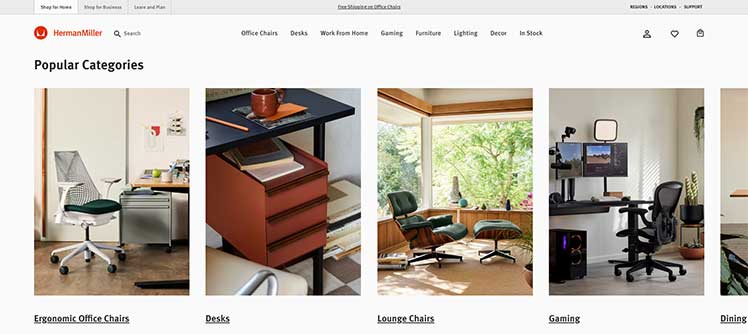

Supercharged E-Ecommerce Platform

ChairsFX called this back in early 2020. As the pandemic kicked off, gaming chair industry sales skyrocketed. Meanwhile, B2B office furniture sales sputtered.

Beyond office closures, this had to do with the way each industry sold its wares. The office furniture industry focuses on B2B sales. These deals are typically done offline by old-school boomers negotiating over martinis.

Meanwhile, for around a decade, a ratty band of gaming chair companies peddled their wares online. After 10 years, most had developed world-class e-commerce systems that put megacorporations to shame.

Herman Miller execs picked up on this problem early in 2020. In just a few months, the company launched Store.HermanMiller.com — one of the most complete online furniture shopping portals in the world.

“The enhanced websites feature fresh and new designs, AI-driven product recommendations, and customer-centric website navigation.” In 2021, e-commerce sales were up 220% over the previous year.

Fast Feedback-Driven Upgrades

This is a big one. Most billion-dollar corporations are lumbering giants that adopt change very slowly. MillerKnoll has a plan to do the opposite. For example, in the fourth quarter 2021, the company launched a black edition Embody Gaming Chair.

This was “part of our strategy to respond quickly to player feedback.”(3) At present, Secretlab is the only other brand that employs a feedback-driven strategy.

Secretlab updates its Titan Series chairs every two years — largely based on user feedback. Can a multibillion mega-giant be as agile as a powerful, efficient, privately-owned operation?

No matter who comes out on top, gamers are likely to enjoy the biggest benefits via product updates.

Post-Pandemic Ergonomic Mentoring

Corporate institutions have a long history of ignoring ergonomic wellness factors. As one example, the back problems caused by wooden seats for school kids were pointed out in the 1800s. Even so, school seating hasn’t changed in over 150 years!

This is also why cheap, non-ergonomic office chairs are ubiquitous in offices. Historically, most employers have cared more about the price-per-chair than the damage it does to spines!

Two words have changed this bad employer habit: ‘Great Resignation‘. People simply aren’t coming back to work for companies offering crappy working conditions.

MillerKnoll Takes Advantage

Google ‘how to attract workers back to office’ and you’ll find dozens of articles providing a range of suggestions. Many of them are clumsy. For example, over at Steelcase, one of the latest innovations is to replace office cubicles with tents!

The idea looks as dumb as it sounds. Even so, many corporate buyers are embracing tent life! It’s a good example that clueless corporations have zero awareness of genuine human needs.

MillerKnoll is already taking advantage of this gap in the market. As workplaces reopen post-pandemic, the company’s B2B business is rebounding.

Its fiscal 2022 Q3 report noted that many contract clients are keen to reopen their offices(4) — with better working conditions.

“As employers consider their spaces, we are seeing a push toward investing in the workplace to create premium spaces and differentiated employee experiences. With a robust product portfolio across many brands, MillerKnoll is ready to meet that demand.”

Steelcase

At the start of the pandemic, Herman Miller CEO Andi Owen declared they could ride out the pandemic or take bold action. Herman Miller took bold action; Steelcase did the opposite. The company chose to ride out the pandemic and hope for the best.

The former top office chair company had a decent but less spectacular 2021 than MillerKnoll. Revenue was up by 11% over the previous year(4). On the downside, ‘inflationary pressures and supply chain disruptions continued to impact operating results.”

Moving forward, the company’s outlook is passive. Steelcase projects 22-27% growth by 2023 — but only if these things happen:

- People return to the office. If they do, the demand for office furniture will increase.

- Supply chain disruptions disappear.

- The company invests more money in marketing & product development.

HNI Corp

In fiscal 2021, the 3rd-ranked HNI Corporation generated $2.2 billion in sales. $1.4 billion (66%) came from workplace furnishings. 34% sold were residential building products(5).

The fourth quarter also showed some downsides. “In the fourth quarter, we continued to confront inflationary pressures, supply chain constraints, and labor shortages.” Future plans:

- Boost eCommerce business for “business simplification and margin-enhancement efforts.”

- Set up a seating factory in Mexico.

- Boost furniture sales once the masses return to working in offices.

Haworth

This privately held, Dutch furniture manufacturer announced global sales of $1.96 billion for 2021(6). That’s a 6.2-percent increase from 2020.

Notably, the company services Europe and Asia but not North America. To serve a growing work-from-home market, Haworth is investing in both digital and retail upgrades.

Office Furniture Industry Trends 2022

Herman Miller was the only major player to proactively tackle lockdown challenges. As a result, it’s the only major office chair company with a clear plan moving forward.

Notably, six of the planned initiatives have to do with spreading ergonomic awareness to a wider audience.

- Knoll acquisition: sets up MillerKnoll as the undisputed global seating leader.

- Consumer + B2B Focuses : cater to both business clients and retail consumers.

- Strong gaming chair division : promote chairs via partnerships with elite gaming influencers.

- Local seating stores : mini-shops for grassroots ergonomic evangelism.

- Slick online shopping portal : make it fun and easy for clients and consumers to shop online.

- Rapid gaming chair upgrades : gather player feedback and upgrade chairs accordingly.

- Corporate ergonomic mentoring : teach clients the business benefits of good ergonomics.

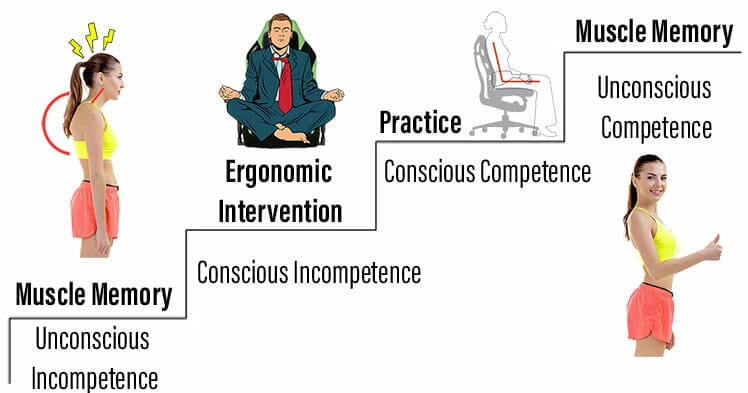

This idea of ‘evangelizing’ ergonomic working benefits is a popular one in the physical therapy world. A popular idea in the therapy community: people adopt sloppy postures because they forget what healthy ones are!

The solution — from a physical therapy perspective — is education. Once people are trained to understand healthy sitting mechanics, they adapt. Here’s the formula:

Recipe: Biomechanical Targets + Muscle Memory = Perfect Posture + Benefits

Below is a summary of trends showing that MillerKnoll’s plan is spot-on. There are indeed gaping holes in many corporations’ post-lockdown plans.

Many of them are related to crappy working conditions on cheap non-ergonomic furniture.

Gamer Habits Shame Corporate Ones

While office seating sales crashed during lockdowns, gaming chair sales skyrocketed. As lockdowns kicked in, reports of back pain went up as folks worked on sofas or dining chairs.

In fact, many top brands broke sales records. Secretlab’s CEO Ian Ang noted that the pandemic sparked surprising demand from office clients.

Once gaming chairs went mainstream, healthy gamer habits did as well. As a result, many teens these days have better computing habits than employed adults.

These days, most gamers know that you need a good chair to support long sitting periods. You also need to counteract sedentary time with exercise. What’s more, sound sleep and good nutrition will keep you sharper while gaming.

50% Of Professionals Lack WFH Skills

Surveys of professionals locked down in 2020 showed many have terrible work-from-home (WFH) habits. When the U. of Cincinnati sent faculty to work-from-home in 2020, researchers sent out surveys. The school sent 85% of them to work from home with only a laptop.

55% worked from hope using the laptop’s screen, rather than an external monitor. Only 45% used a chair with adjustable armrests. Therefore, researchers sent out a memo advising staff to buck up.

Five months later, around 30% continued to work on a makeshift desk (their lap, a pillow, a sofa arm, etc). 55% continued to use the laptop screen rather than an external one. Around 45% continued to use non-adjustable chairs (like dining table seats).

As a result, WFH pain reports were high:

- Neck pain and headaches: reported by 49% of respondents.

- Low back pain: reported by 45%.

- Upper back and shoulder pain: 62% suffered moderate to severe pain.

The problem is that sloppy sitting habits crush worker productivity. Around 30 million Americans suffer from chronic back pain. Around 42% are obese. An estimated 2/3 are believed to suffer from chronic fatigue.

The U. of Cincinnati study ended with two suggestions:

- Companies should provide staff with the right tools for WFH deskwork.

- Employers should also teach their staff healthy deskwork habits.

As it turns out, both are huge parts of MillerKnoll’s master strategy.

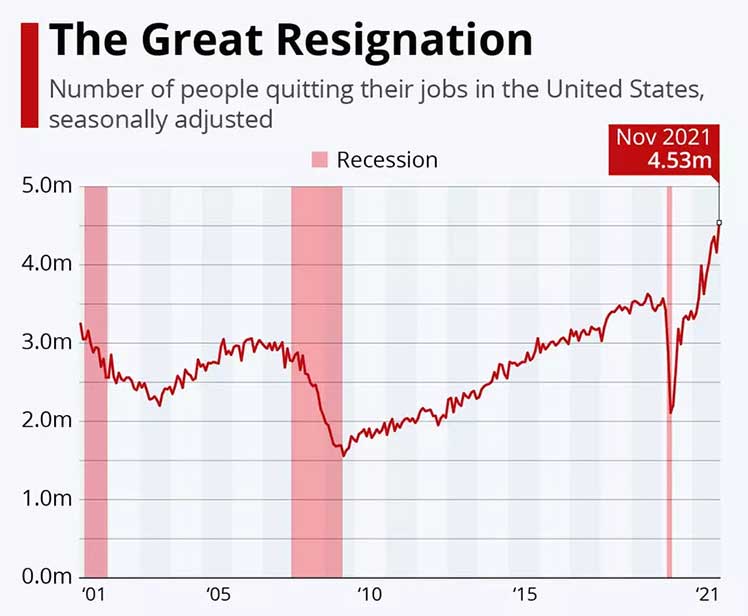

Dreary Corpo Life = Great Resignation

As the previous section shows, many professionals were sent to work from home without proper tools. As well, to keep their ‘managers’ happy, many had to multitask across email, groupware, chat, and conferencing apps.

On top of balancing apps, many also had to manage messaging across both PCs and phones. With no equipment, chronic pain, and excessive communication demands, the WFH experience can be horrific.

Unsurprisingly, after the lockdowns ended, 30% of the American workforce quit their jobs (around 47 million people).

As companies struggle to lure workers back, MillerKnoll offers a solution. In the MK 2022 Q3 Report, it’s mentioned:

“As employers consider their spaces, we are seeing a push toward investing in the workplace to create premium spaces and differentiated employee experiences. With a robust product portfolio across many brands, MillerKnoll is ready to meet that demand.”

Emerging Technostress Issues

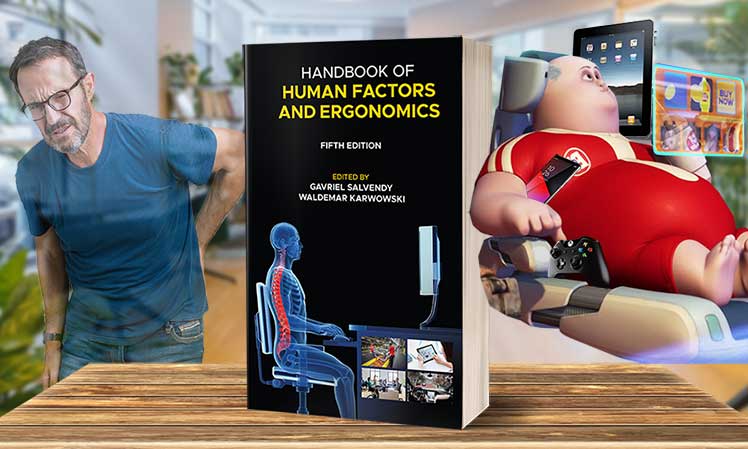

The Handbook of Human Factors and Ergonomics documents the latest standards in workplace environment design. The latest 5th edition (2021 update) calls for a shift in ergonomic priorities.

Instead of healthy desk-based PC computing, the new focus is on ubiquitous computing across multiple devices.

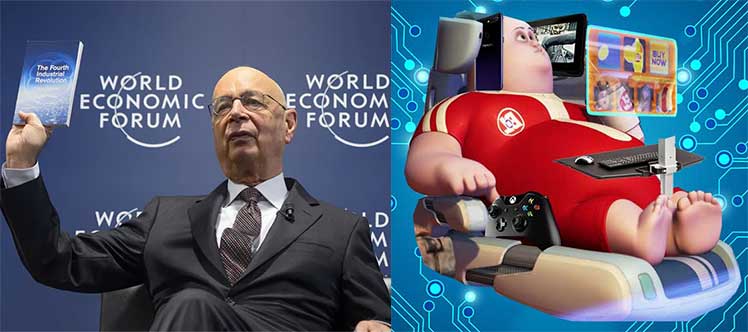

This is in sync with the World Economic Forum (WEF) plan to usher in a ‘Fourth Industrial Revolution’.

The idea is to hook everyone up to a ‘metaverse’. It will see “billions of people connected by mobile devices, with unprecedented processing power, storage capacity, and access to knowledge…”

According to the Handbook, ergonomic researchers must find ways to enable techno immersion while mitigating technostress. There are three main types of technostress. MillerKnoll (and other office furniture companies) get to tackle the first one:

- Physical technostress : extended use of laptops, tablets, and smartphones increases the risks for musculoskeletal disorders.

- Mental technostress: cognitive overload comes from using too many complicated gadgets at once.

- Techno-addiction: inability to disconnect from work. Techno-addicts compulsively perform work-related tasks outside of business hours.

Existing Musculoskeletal Issues

It’s well-known in the esports world that healthy, rested & comfortable players perform better. In fact, most savvy gamers apply a 3-step blueprint that anyone can adopt:

- Adequate rest, exercise, and nutrition. Eating healthy food, sleeping well, and exercising regularly keep bodies and brains sharp.

- Use an ergonomic computing workstation. Get a good ergonomic chair, adjustable computer screens, and a desk.

- Take frequent breaks. Frequent breaks get your body moving. It also gives your brain time to reset before another ultra-productive burst of work.

If teenybopper gamers playing Fornite can adopt healthy computer habits, so can desk working adults. With help from office furniture players like MillerKnoll, corporations have the means to make this happen.

By improving the working habits of their employees, companies will enjoy higher production. But those improvements will also bring life-changing benefits to their staff.

As a result, companies can gain tremendous loyalty from suddenly happy, healthy, and motivated workers! Here are some of the most common musculoskeletal disorders that ergonomic interventions can address:

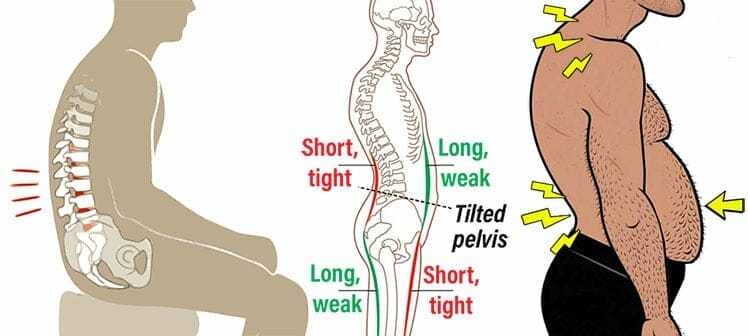

Misaligned Spine

The human body is not designed to sit for long periods. Without proper ergonomic support, that causes well-documented problems.

Specifically, unsupported sitting flattens the lower back curve. That throws the entire body out of alignment. For this reason, all ergonomic chairs are designed to support neutral sitting postures.

These postures preserve the same lower back curve angle as if in a healthy standing posture. That keeps the spine in a healthy alignment while sitting.

Anterior Pelvic Tilt

As the lower back tightens, stomach muscles weaken and get longer. At the same time, hamstrings weaken while quad muscles tighten.

These misalignments tilt the hips, curve the upper spine, and tilt the head forward. As a result, some studies estimate that over 80% of American adults suffer from anterior pelvic tilt(8).

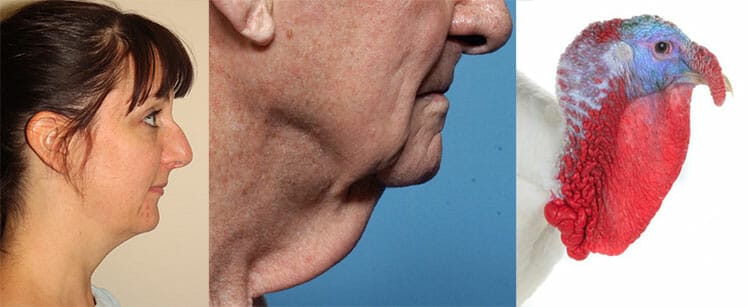

Text And Turkey Neck Syndrome

Studies suggest that the average person spends around 3 hours daily using a cell phone. Most people do so with a 45° forward neck bend. That exerts an extra 50 pounds of pressure on neck and shoulder muscles.

When stacked with poor sitting habits, a forward neck tilt is disastrous! Over time, that posture can lead to a severe state of kyphosis.

That almost completely flattens the lower back curve. As a result, the neck bends so far forward that it rounds the upper spine. That turns sloppy sitters into hunchbacks!

FYI, weakened necks are also the reason so many people develop turkey neck syndrome. When neck muscles weaken, the skin around them loses elasticity. As a result, skin under the chin sags down into what resembles a turkey’s neck!

Chronic Pain

Sitting at a desk in 8-hours shifts — with poor posture — misaligns the spine and surrounding muscles. To hold itself upright, the body must compensate by placing pressure on other muscles.

As pressure builds up, pain emerges. Here are some common pain issues suffered by desk-bound workers:

- Wrist disorders: 4 million Americans suffer from carpal tunnel syndrome.

- Neck pain: the fourth-leading cause of disability in America.

- Shoulder pain: Americans average 4.5 million doctor visits and $3 billion in associated health costs.

- Elbow and forearm pain: 1-3% of all Americans suffer from elbow tendonitis, aka tennis elbow.

Low back disorders: 31 million Americans are suffering from low back pain at any given time.

Learn more about deskwork-related pain problems in this feature:

Excessive Sedentary Behavior

As people begin to suffer back pain, they tend to move less. This is a small part of a larger trend towards excessive sedentary behavior.

For example, University of North Carolina researchers looked at data collected since the 1960s on activity habits. Then, they projected those trends to 2030.

The green line plots activity levels in America; the red one plots sedentary time. From around the year 2000, we see (green) activity levels steadily dropping while (red) sedentary levels trend upwards.

ChairsFX asked Dr. William Duncan about sedentary health risks. His answer:

“We, as humans, are built and designed to stand upright. The cardiovascular and digestive systems are designed around being vertical.

So when we sit for extended periods of time, the body will look for more energy-efficient means of support – a chair. While a chair can be extremely useful for short bouts of sitting, the extended time spent in a chair can create small changes in the body that have a large, long-lasting impact.”

Long-Term Health Issues

If you let yourself descend too far, you might end up bloated, immobile, and sickly. Then, you’re likely to feel tired, irritable, and unhappy all the time! Aside from being unable to produce at work, this state of being leaves one vulnerable to serious health problems.

Here are some of the serious long-term health issues caused by excessive sedentary behavior:

- Obesity: waist circumference increases by 3.1 cm with a 10% increase in sedentary time. As people gain weight, they feel less compelled to move.

- Diabetes: excess sedentary time increases type 2 diabetes risks. Regular exercise only slightly offsets this risk. Symptoms include tingling extremities, dry skin, and excessive urination.

- Cancer: prolonged sitting increases colorectal, endometrial, ovarian, and prostate cancer risks. It also increases cancer mortality (mainly in women).

- Hypertension: sedentary behaviors reduce blood pressure. That alters cardiac output and total peripheral vascular resistance.

- Osteoporosis: slothful living lowers bone mineral density in the femur and hip sub-regions. That makes bones brittle and easy to break.

Industry Predictions: Beyond 2022

Based on the facts outlined in this report, here are some broad predictions for the coming years:

Emerging 4th Industrial Revolution

Leading Herman Miller investor BlackRock is a World Economic Forum partner(9). WEF Chair Klaus Schwab touts our present time as The Fourth Industrial Revolution.

It’s supposed to be an evolution of interconnectivity that blurs the lines between the digital, physical, and biological worlds.

This will lead to a state of ‘ubiquitous computing’. That will fuse “artificial intelligence, robotics, the Internet of Things, autonomous vehicles, 3-D printing, nanotechnology, biotechnology, materials science, energy storage, and quantum computing.”

Standing in the way of this plan are the realities of human physiology. Humans evolved over millions of years to move their bodies.

Spending sedentary days locked in a metaverse will have serious physical and mental consequences. There are several existing and emerging ones.

MillerKnoll Will Dominate

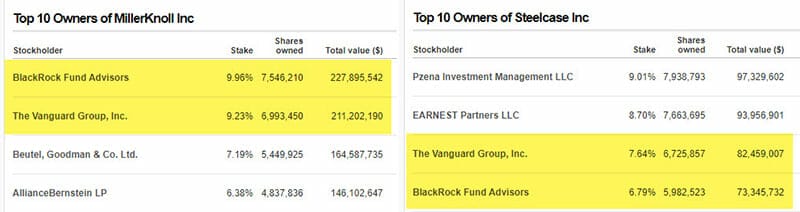

Blackrock and Vanguard are the two biggest investment firms in the world. BlackRock manages almost $10 trillion in investments; Vanguard around $8 trillion. That’s around 40% of all shares in the S&P 500 (about $38 trillion).(10)

These companies are the largest institutional investors in Apple, Microsoft, Google, Amazon, Tesla, and Nvidia. That gives them a say in the furniture choices of the world’s megacorporations.

That’s significant because BlackRock and Vanguard have big investments in both MillerKnoll and Steelcase. However, their combined stake of $439 million in MillerKnoll dwarfs their $155 million Steelcase investment.

4th Industrial Revolution Ergonomic Solutions

To overcome the musculoskeletal challenges of the emerging techno-age, people will need the right equipment — and proper ergonomic training. With that in mind, MillerKnoll’s 7-step plan (plus its WEF supporters) looks like the perfect strategy for these times:

- Knoll acquisition: sets up MillerKnoll as the undisputed global seating leader.

- Consumer + B2B Focuses: cater to both business clients and retail consumers.

- Strong gaming chair division: promoted via partnerships with top gaming influencers.

- Local seating stores: mini-shops for grassroots ergonomic evangelism.

- Slick online shopping portal: make it easy for clients and consumers to shop online.

- Rapid gaming chair upgrades: gather player feedback and upgrade chairs accordingly.

- Corporate ergonomic mentoring: teach clients the business benefits of good ergonomics.

With corporate backing at the highest levels, MillerKnoll’s plan looks to be an almost sure thing. The only projected hurdle comes from the pesky, annoying gaming chair industry.

Gaming Chair Industry Threat

The ergonomic office furniture industry generates around $50+ billion in revenue every year. In comparison, the ragtag gaming chair industry only generates a few hundred million.

Despite the size difference, the gaming chair industry has been a pesky thorn in the giant’s side. During 2020 lockdowns, most office chair companies had flimsy consumer sales channels. As a result, gaming chair sales skyrocketed while office chair sales tanked.

Circa 2022, the gaming chair industry continues to be a nuisance. Five top brands lead the way with lean, agile, development teams. Each has strong consumer channels developed over several years.

Strong customer relationships plus rapid innovation yield faster reaction times to rapidly-evolving ergonomic seating trends.

Can the behemoth office furniture industry keep up with this pace? Based on its stated goals, MillerKnoll seems primed for the challenge. Learn more in this feature:

Office Chair Industry Report 2023

How accurate were our 2022 performance predictions? This report ranks the top office furniture companies of 2022 – based on the previous year’s actual earnings.

A year after writing this, our 2023 Office Furniture Industry Report has also been published. The first column reveals how the top companies actually performed in 2022:

| 2022 Earnings (USD billions) | 2021 Earnings | 2020 Earnings (Pre-pandemic) |

|

Wild Card: MillerKnoll $3.9 Billion combined ▲

|

Wild Card: MillerKnoll $3.5 Billion combined

|

|

In the next chapter of the story, Steelcase, Haworth, and the HNI Corporation are all trending upwards — assuming hybrid working styles continue. Meanwhile, the biggest industry player in the room faces (predicted) growing pains.

Herman Miller’s focus on integrating Knoll into the MillerKnoll juggernaut has given others opportunities to catch up:

Office Furniture Industry Report 2023 (NEW)

Footnotes

- Herman Miller, Inc. ‘Herman Miller Completes Acquisition of Knoll’, July 19 2021. https://news.millerknoll.com/2021-07-19-Herman-Miller-Completes-Acquisition-of-Knoll, (accessed June 5 2022).

- MillerKnoll. ‘Annual Report 2021’. August 31, 2021. https://www.millerknoll.com/investor-relations/financials-filings/annual-report, (accessed June 5 2022).

- MillerKnoll. ‘Herman Miller Reports Fourth Quarter Fiscal 2021 Results’. June 28, 2021. https://news.millerknoll.com/2021-06-28-Herman-Miller-Reports-Fourth-Quarter-Fiscal-2021-Results, (accessed June 5 2022).

- MillerKnoll. ‘MillerKnoll, Inc. Reports Third Quarter Fiscal 2022 Results’. March 29, 2022. https://news.millerknoll.com/2022-03-29-MillerKnoll,-Inc-Reports-Third-Quarter-Fiscal-2022-Results, (accessed June 5 2022).

- ‘Steelcase Reports Fourth Quarter and Fiscal 2022 Results’. March 23, 2022. https://ir.steelcase.com/news-and-events/news/news-details/2022/Steelcase-Reports-Fourth-Quarter-and-Fiscal-2022-Results/default.aspx, (accessed June 5 2022).

- ‘HNI Corporation 2021 Annual Report’. February 4, 2022. https://investors.hnicorp.com/financials/annual-reports/default.aspx, (accessed June 5 2022).

- Jayson Bussa. ‘Haworth global sales improve, inch back to pre-pandemic levels’. March 3, 2022. https://mibiz.com/sections/manufacturing/haworth-global-sales-improve-inch-back-to-pre-pandemic-levels, (accessed June 5 2022).

- Lee Herrington. ‘Assessment of the degree of pelvic tilt within a normal asymptomatic population’. Manual Therapy Volume 16, Issue 6, December 2011, Pages 646-648. DOI: doi.org/10.1016/j.math.2011.04.006 (accessed June 5 2022).

- WEF website. ‘BlackRock’. Partners. https://www.weforum.org/organizations/blackrock-inc (accessed June 5 2022).

- Farhad Manjoo. ‘What BlackRock, Vanguard and State Street Are Doing to the Economy’. Opinion, May 12, 2022. https://www.nytimes.com/2022/05/12/opinion/vanguard-power-blackrock-state-street.html (accessed June 5 2022).