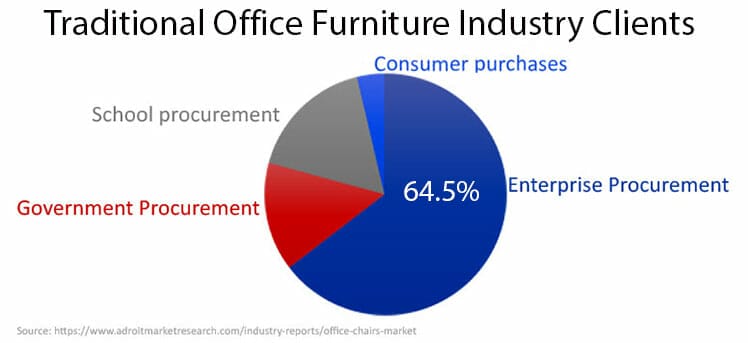

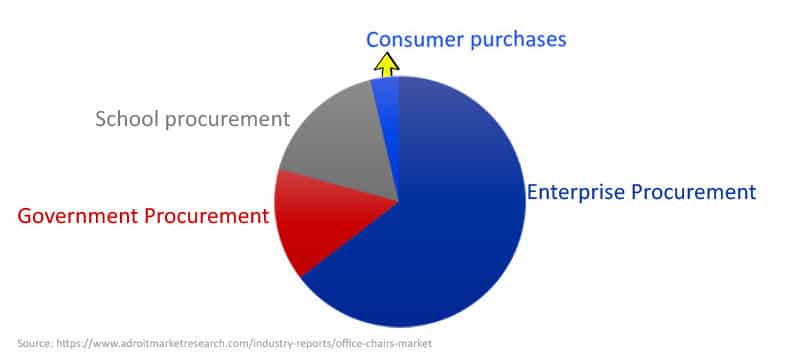

The massive office chair industry generates billions each year in B2B sales. Corporations account for around 65% of all business. Government offices and schools make up most of the rest. Consumer sales are an afterthought. But when lockdowns hit, this lucrative business model ground to a halt. Now, the biggest players in the game have started to rebound. This 2020 office chair industry report documents the big crash — and the road to recovery.

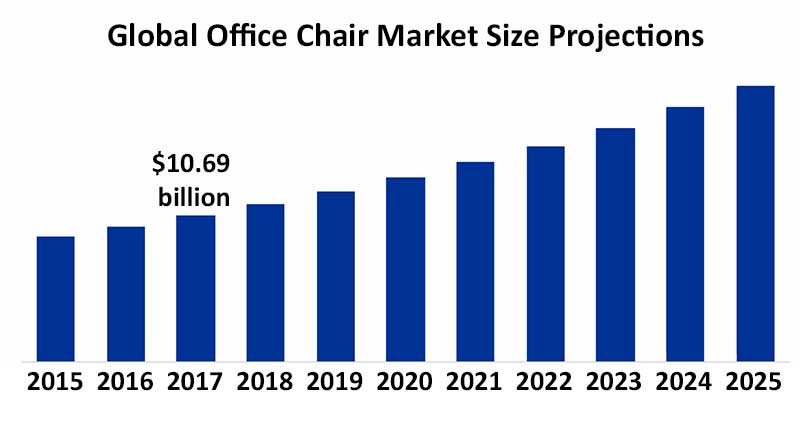

In 2017, market experts valued the office chair industry at around $10.69 billion dollars(1). Year-by-year growth was pegged at around 6%.

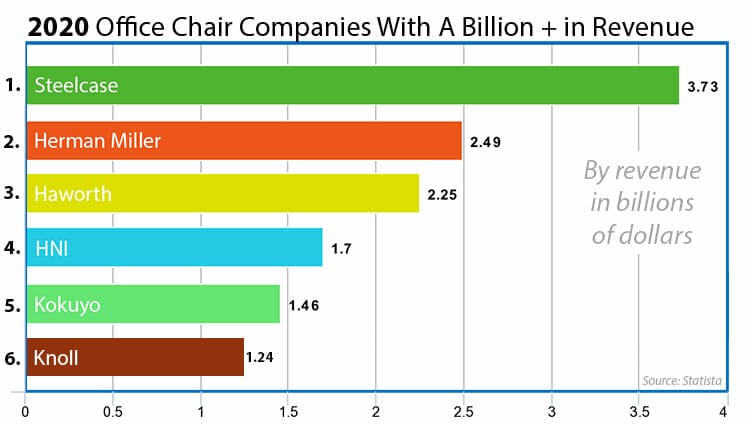

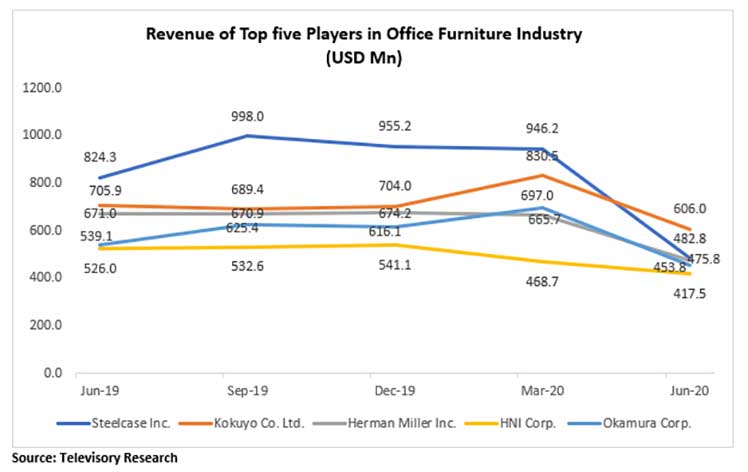

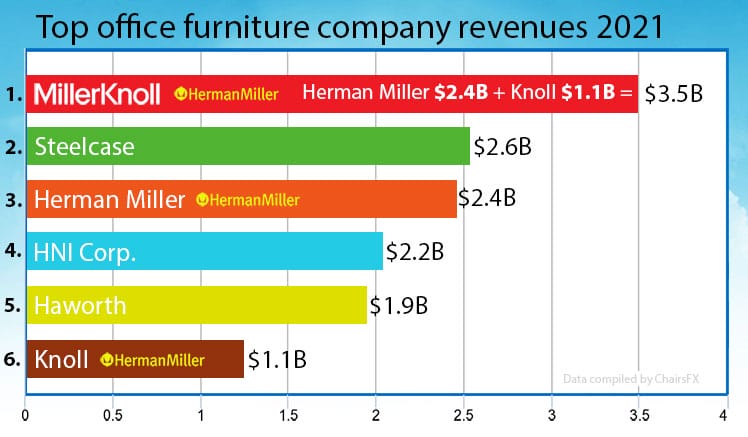

In terms of annual revenue, Steelcase has held the top spot for several years. Based on pre-pandemic (late 2019) figures, the company had generated $3.73 billion in sales. Herman Miller ranked a distant second with $2.49 billion in sales.

Only a small fraction comes from consumer sales — the industry operates mainly as a B2B service. Enterprise sales make up 64.5% of the total, followed by sales to government offices and schools.

Experts have given a few different reasons for expected growth:

- Industrialization in emerging economies drives demand for bulk office furnishings(2).

- A growing number of startups and tech parks in America also need furnishings. There is also a Canadian surge in retail and office space construction(3).

- Rising demand for ergonomic, healthy solutions to replace outdated office chairs(1).

Office Chair Industry B2B Model Crash

Most of the seating you see in schools and offices around the world is non-ergonomic. This is because the office chair industry earns billions each year selling cheap, durable furniture to schools and corporations.

Traditionally, enterprise chair buyers haven’t cared about ergonomics(4). Instead, it’s been price, style, and durability that win big B2B sales contracts.

When lockdowns hit in early 2020, this model crashed. That exposed the longtime obsolescence of non-ergonomic seating — and a ravenous desire among the masses for ergonomic sitting support.

Lockdowns Crushed B2B Furniture Sales

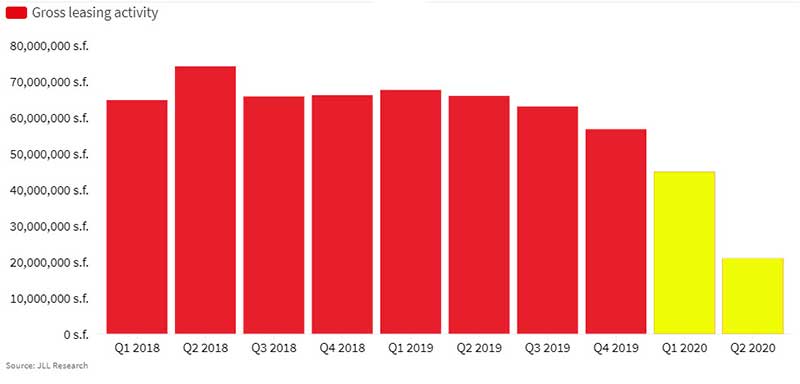

In Q1 2020, the global pandemic caused major disruption in the office space market(5). Occupancy dropped by 14 million square feet. Gross leasing dropped by 53.4%.

This year, over 30 million Americans have requested unemployment insurance. The U.S. jobless rate in April reached 14.7%, an all-time high(6). In Canada, the construction business was down by 9% in Q1 2020.

Worldwide, ongoing social distancing ensures low traffic in retail spaces. Schools are switching to distance learning models. Most offices are empty.

With schools closed and millions now working from home, projected demand has evaporated. For instance, Steelcase (one of the world’s largest office furniture companies) laid off most of its production staff in April 2020(7).

Notably, while lockdowns slowed enterprise demand, they skyrocketed consumer demand for ergonomic office furniture. In the process, the dangers of non-ergonomic seating finally reached the mainstream consciousness.

Non-Ergonomic Desk Chairs Are Obsolete

Non-ergonomic office chairs are bad for your back. These chairs have limited features that force users into fixed sitting positions. That’s been a problem for over 100 years.

As the Industrial Revolution kicked off in the late 1800s, farming jobs gave way to clerical ones. Then, sitting full-time became a social norm. As a result, the standard office chair emerged.

At the time, knowledge of healthy sitting biomechanics was non-existent. As a result, these chairs were designed to be cheap and durable. Healthy spinal support was a non-issue.

Over a century later, not much has changed. Most full-time desk workers still spend their days torturing their spines using non-ergonomic chairs.

Healthy Sitting Guidelines Are Clear

For decades, office chair companies have earned billions by peddling non-ergonomic seating to stingy corporations. That earns CEOs a big bonus, while the employees get rewarded with back pain! This is why well-documented ergonomic chair guidelines have been ignored (on an institutional level) for so long.

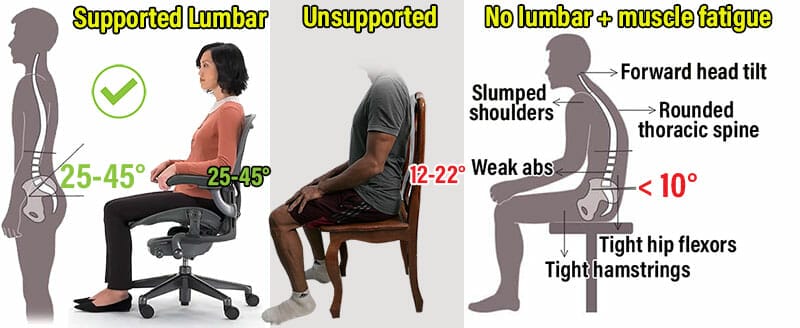

Fact: any chair that qualifies as ‘ergonomic’ has an adjustable lumbar, adjustable armrests, and a reclining backrest.

These components prevent spinal distortion. In a healthy standing position, the lower back maintains a 25-45° angle. Sitting without support flattens that curve by half.

That forces back muscles to work harder at holding the spine upright. Once back muscles tire, the spine then collapses into an ugly ‘c’ shape.

Even OSHA (Occupational Safety and Health Administration) rejects traditional office chairs. Their office chair standards also demand adjustable armrests, lumbar support, and a reclining backrest(8).

There was no incentive for change — until the 2020 lockdowns hit. Then, the masses learned the hard way why non-ergonomic furniture is bad for your back. As a result, lockdown demand for ergonomic furniture skyrocketed.

Widespread WFH Back pain

When lockdowns hit, millions were forced to study or work from home. Many, unprepared for the sudden switch, toiled away on dining chairs, sofas, and beds. As a result, doctors reported a surge of lower back pain complaints(9).

A pair of lockdown surveys conducted at the U. of Cincinnati boiled the problem down to two factors. The first was a lack of ergonomic equipment. The second was a lack of healthy sitting awareness among employees.

Staff Sent Home Ill-Equipped

During early spring lockdowns, the first survey found poor support from HR. The school sent 85% of faculty to work from home with only a laptop. Half worked on chairs without adjustable arms. Many used ‘makeshift desks’ (laps, pillows, etc).

The surveyors sent out three suggestions to the faculty:

- Work from home using an ergonomic chair.

- Connect your laptop to an external screen (to avoid bending your neck).

- Use an external mouse and keyboard (also to prevent neck bends).

Five months later, a second survey was sent out. It found that around half of all staff continued to work on sofas, dining tables, or atop makeshift desks.

As a result, pain reports were off the charts:

- Neck pain and headaches: reported by 49% of respondents.

- Low back pain: reported by 45%.

- Upper back and shoulder pain: 62% suffered moderate to severe pain.

The researchers ended their report with two obvious conclusions:

- Companies that send employees to WFH need to give them the right tools for the job. That includes an ergonomic chair plus an external screen, mouse, and keyboard.

- Since many (especially older) staff are inept, they’ll also need ergonomic training.

Lockdown Gaming Chair Sales Spike

Soon after the lockdowns started, back pain reports came flooding in. However, the office chair industry’s B2B model was not equipped to service that demand. As a result, office chair sales crashed hard.

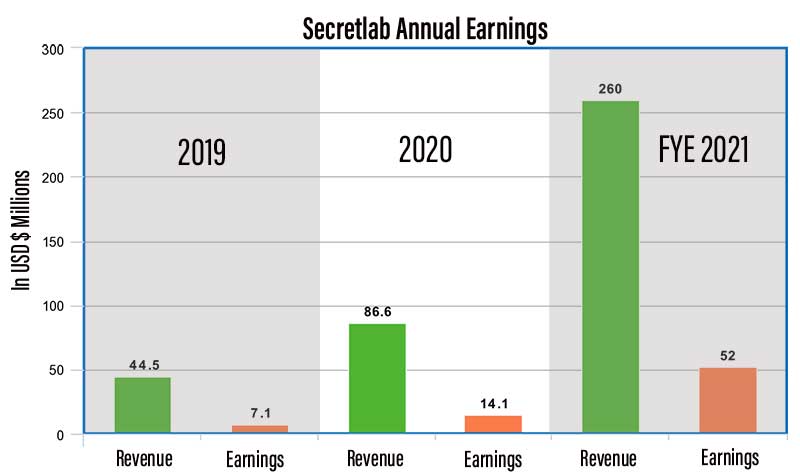

In contrast, full-back, racing-style gaming chairs were breaking sales records. For instance, in 2020, Secretlab’s sales doubled over the previous year. A surprising number of orders came from non-gaming enterprise clients.

The big disparity in sales between the two industries comes down to three characters: B2C. When demand for home furniture spiked, the office chair industry’s B2B model was useless. One Steelcase supplier explained(10) the problem: “We’re not used to dealing with the end-user.”

In sharp contrast, since the first gaming chair emerged in 2006, the industry has been wholly B2C. As a result, when lockdowns hit, gaming chair companies were well-equipped to handle consumer demand.

As that happened, billion-dollar office chair companies were left watching passively from the sidelines. Learn more:

Gaming Vs Office Chair Industry

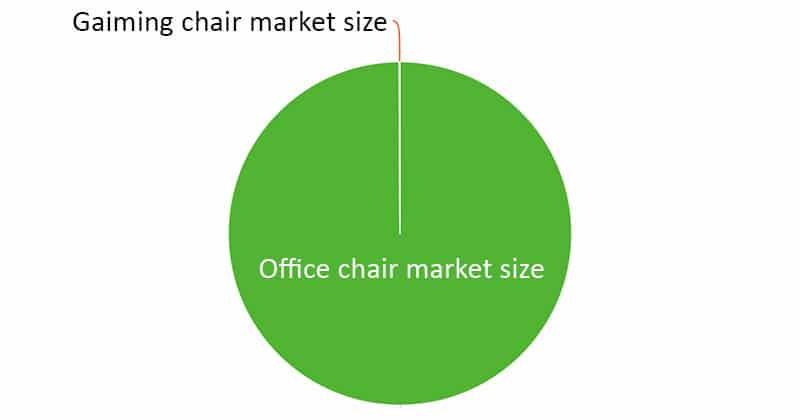

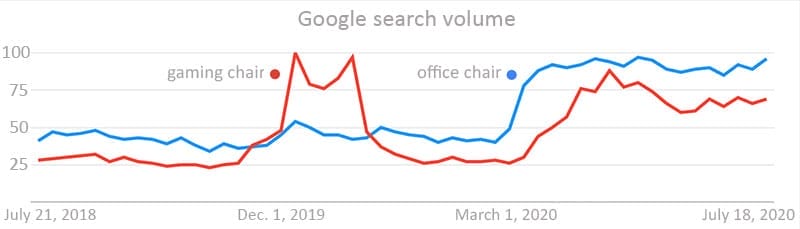

The global office chair industry was valued at $10.6 billion in 2017. In contrast, the gaming chair industry had a market size of less than $10 million in 2018. Gaming chair analysts predict annual growth of 5%. By 2024, the gaming chair industry is predicted to have a market size of around $70 million.

From this perspective, the gaming chair industry poses no threat to the office chair industry.

However, despite the massive difference in market sizes, Google trends show a narrower gap in consumer search interest. That gap is because the tiny-by-comparison gaming chair industry has several advantages in the consumer market.

2020 Office Chair Industry Challenges

The office chair industry operates as a B2B service. Most top brands sell to enterprises, schools, and government offices are the key drivers. Consumer sales make up only a fraction of annual revenue.

With offices and schools closed, B2B demand has evaporated. But with millions now working and studying from home, consumer demand for ergonomic products has skyrocketed.

This new reality poses several challenges for the massive, slow-moving multi-billion-dollar office chair industry.

Global Shift To Working From Home

During the 2020 pandemic lockdowns, around 42% of the American labor force worked from home. Stanford economist Nicholas Bloom believes that this trend is here to stay(11). “Once the COVID-19 pandemic passes, rates of people working from home will explode.”

Working from home disrupts the office chair industry business model. Office chair industry sales focus on generating B2B leads(12). But in the work-from-home era, it’s not corporate buyers driving demand, but consumers. In that arena, the gaming chair industry has a massive advantage.

Lack Of Consumer Relationships

The commercial office chair industry sells to schools, enterprises, and government offices. E-commerce sales to consumers have never been a major factor. But with the mass switch to working from home, commercial sales have dried up.

Some analysts now predict 2-3 years of hard times for the office furniture industry. During this time, the whole industry must integrate consumer sales into its long-term plans(13). This comes with clear challenges:

- Consumer marketing: how to drive consumers to office products — with no retail marketing presence?

- Taking orders: an internal digital team must process customer orders.

- Fulfillment: this needs warehouses and shipping partners.

Meanwhile, the gaming chair industry already solved these challenges. Most top gaming chair brands have those processes running with precision. For instance, Singapore-based Secretlab is the gaming chair industry leader.

Secretlab maintains warehouses in America, Canada, Europe, and Oceania. They also have a robust online ordering and customer support system. Customers need only visit their website, order a chair, and wait for delivery. It’s a simple, effective process.

After-care is also on-point. If you have problems with chairs from any leading brand, you can get fast support. Reach out on the brand’s website or any of its social media channels.

Inefficient Marketing

The gaming chair industry has a marketing reach that even the juggernaut office chair industry can’t match. For several years, most top brands marketed their chairs by sponsoring streamers, esports teams, and esports tournaments.

For instance, celebrity streamers like Ninja, Pokimane, and Pewdiepie all have gaming chair sponsors. Each has millions of followers. During each and every stream, their gaming chairs are on display.

Against that massive exposure, the billion-dollar office chair industry has nothing. Traditionally, they’ve reached their B2B market old-school, using TV spots, radio jingles, and newspaper ads.

Outdated User Relationships

Office chair industry relationships are with big enterprises. On the other side, top gaming chair brands have established direct relationships with their customers. Those customers include famous streamers, pro esports teams, and run-of-the-mill consumers.

There’s an organic connection. Many top brands like Secretlab,Maxnomic, and GTRacing are all “made by gamers for gamers”. These brands share a passion for esports, which demands long periods of sitting with peak cognitive performance.

Thus, the people designing the chairs are familiar with the challenges of seated computing. As a result, gaming chair evolution happens quickly.

In contrast, Don Chadwick (one of the designers of the Herman Miller Aeron) is 84 years old. The other passed away. This “old guard” has little experience with the gamer-driven realities of modern computing.

2022 Office Chair Industry Report

Two years after writing this report, we followed up with another. Our 2022 Office Chair Industry Report shows how things worked out exactly as we predicted.

Herman Miller took the boldest actions post-lockdown to shore up consumer sales. Key moves:

- Fast setup of a slick e-commerce website for consumers.

- Partnerships with famous esports stars.

- Local popup shops for grassroots ergonomic outreach.

But the company’s boldest move was its acquisition of Knoll. In 2020, Knoll ranked as the 6th-largest office furniture company in the world, with $1.24 billion in annual revenue. Combined, the two formed MillerKnoll, the largest office furniture company ever.

Meanwhile, Steelcase elected to ‘ride out’ pandemic challenges. Instead of taking action, they’ve been laying low, waiting for the world to get back to normal.

That has left Herman Miller without any competitive obstacles. As a result, this new juggernaut has started rolling out an elaborate 7-point plan for world domination.

In 2022, MillerKnoll operates both enterprise and consumer divisions. On the consumer side, they’ve rolled out rapid upgrades, new esports partnerships, and a sweet online shopping experience.

On the corporate side, they’ve even got a mentoring plan to address corporate WFH failings. Read the full story:

Office Chair Industry Report: 2022 Edition

Footnotes

- Adroit Market Research. ‘Global Office Chairs Market Size 2017’. Consumer Goods Research Reports. https://www.adroitmarketresearch.com/industry-reports/office-chairs-market, (accessed 19 Dec. 2021).

- ‘Global Office Chairs Market Outlook’. Market Outlooks. https://www.factmr.com/report/942/office-chair-market, (accessed 19 Dec. 2021).

- ‘Office Chair Market: North America Prevails at Vanguard; Europe to Record Moderate Rise’. Media Releases, June 28, 2018. https://www.factmr.com/media-release/525/office-chair-market, (accessed 19 Dec. 2021).

- ‘Guidelines (Principles) in selecting office furniture’.Office Management, https://accountlearning.com/guidelines-principles-in-selecting-office-furniture/, (accessed 19 Dec. 2021).

- Phil Ryan. ‘US Office Market Statistics, Trends & Outlook’. April 13, 2020. https://www.us.jll.com/en/trends-and-insights/research/office-market-statistics-trends, (accessed 19 Dec. 2021).

- ‘United States Unemployment Rate’. April 20, 2020. https://tradingeconomics.com/united-states/unemployment-rate, (accessed 19 Dec. 2021).

- Brian McVicar. ‘Steelcase lays off nearly all production employees amid coronavirus pandemic’. March 24, 2020. https://www.mlive.com/news/grand-rapids/2020/03/steelcase-lays-off-nearly-all-production-employees-amid-coronavirus-pandemic.html, (accessed 19 Dec. 2021).

- OSHA. ‘Computer Workstations eTool’. U.S. Department of Labor, https://www.osha.gov/etools/computer-workstations, (accessed 19 Dec. 2021).

- Advisory Board. ‘Injuries are surging as more Americans work from home’. September 10, 2020. https://www.advisory.com/daily-briefing/2020/09/10/work-from-home-injuries, (accessed 19 Dec. 2021).

- Timothy Aeppel. ‘Work-from-home boom is a bust for big office furniture makers’. September 29, 2020. https://www.reuters.com/article/us-health-coronavirus-office-furniture-a-idUSKCN26F2HN, (accessed 19 Dec. 2021).

- Delphine Strauss. “Nick Bloom: ‘It is becoming pretty clear now that hybrid working is here to stay'”. Economists Exchange, December 22, 2021. https://www.ft.com/content/c3ada896-c7df-46a0-bb23-10aa723fd1e9, (accessed 19 Dec. 2021).

- Salesleads. ‘Office Furniture Sales Leads vs Prospects: What’s the Difference?’ October 21, 2018. https://www.salesleadsinc.com/blog/2018/october/office-furniture-sales-leads-vs-prospects-whats-the-difference, (accessed 19 Dec. 2021).

- Office Fitness Ninjas. ‘How COVID-19 Reshaped the Office Furniture Industry Overnight’ December 21, 2020. https://www.workwhilewalking.com/open-office-layout-covid-19-impact-on-future-design-of-commercial-office-spaces-and-home-office-accommodations, (accessed 19 Dec. 2021).