Gaming chair prices have risen steadily over the past three years. That has made many people dubious of so-called ‘gaming chair sales’. One theory is that furniture brands raise chair prices before putting them on sale. These ‘sales’ lower the inflated prices, creating the perception of a discount. This article tests that conspiracy theory. Find below gaming chair price trends from 2021 to 2023 — plus trackable reasons for price increases.

Herman Miller recently held its annual Holiday Sale. Instead of celebrating, Reddit’s r/OfficeChairs/ pulled out pitchforks. Citing recent price increases, they declared Herman Miller ‘sale’ pricing a scam.

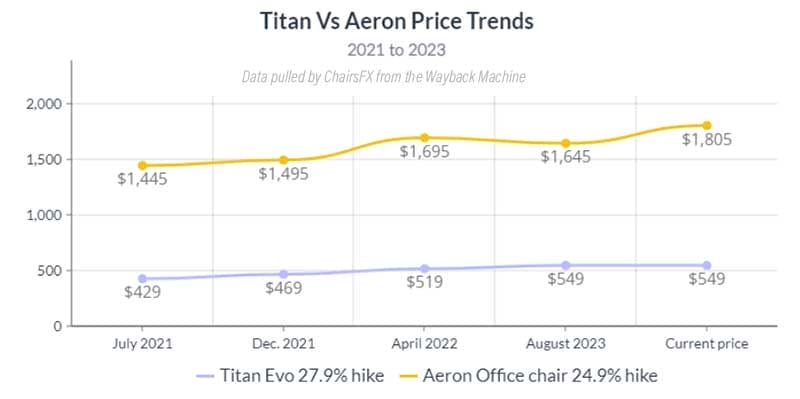

Using the Wayback Machine, I looked at archived chair prices for a fully-loaded Aeron Remastered office chair. The Redditors were correct: Herman Miller did raise prices shortly before announcing its Holiday ‘Sale’.

For instance, in August, a fully-loaded Graphite frame Aeron cost $1645; a month later, the price increased by 9.7% to $1805. A month after that, Herman Miller’s holiday sale offered customers 25% off.

Shaving off the 9.7% price hike, the actual discount offer works out to 15.3% off — still a great deal. Digging deeper, I analyzing MillerKnoll’s 2023 Annual Report(1). Several factors made price hikes necessary.

Yet, customers were still offered legitimate 15% savings over average 2023 prices. That debunks Reddit’s r/OfficeChairs/ accusations. Herman Miller’s Holiday Sale was legit.

Market conditions (too complicated to explain in sales promotions) necessitated a price hike. Under the circumstances, Herman Miller still managed to bring real holiday savings to its customers.

Gaming Chair Price Trends Since 2021

Some chair buyers have questioned the authenticity of ‘discounted’ gaming chair prices. This section addresses that by listing relevant gaming chair and office chair prices from 2021 (pre-pandemic) to the present.

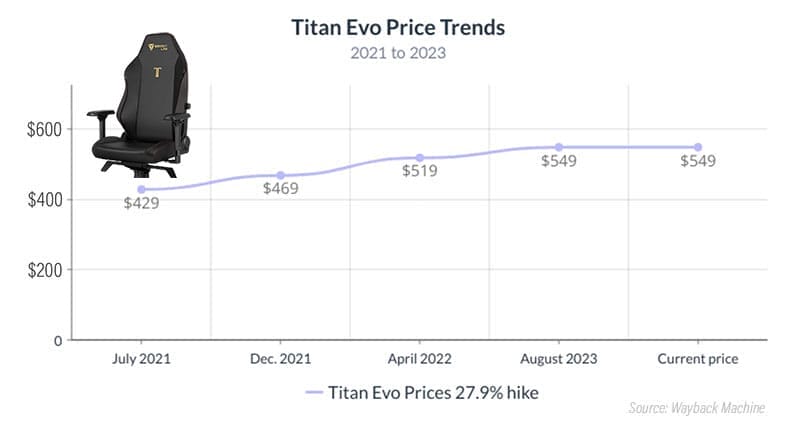

Secretlab Titan: +27.9%

In July 2021, Secretlab released an upgraded Titan Evo edition with a debut price of $429 (for the medium-sized Stealth edition). In November 2023, a medium Titan Evo Stealth costs $549 — a 27.9% rise over its 2021 debut price.

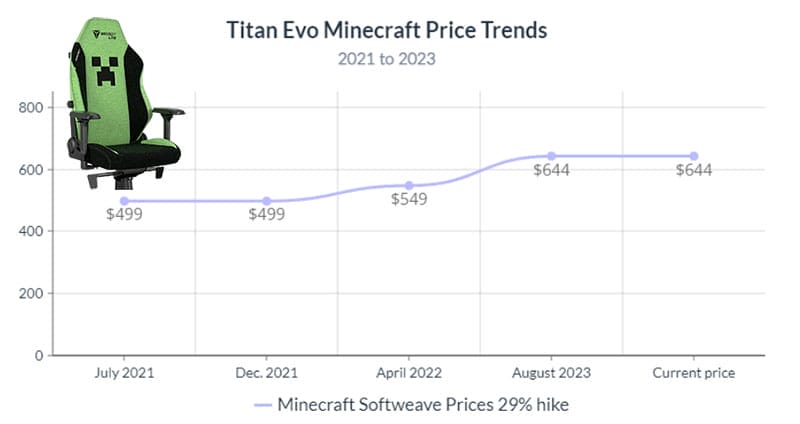

Stock designs like the Stealth are the cheapest. Softweave and specialty editions cost more. Specialty Softweave editions like the Minecraft chair cost the most. Minecraft Softweave chair price history:

Over three years, the average price of these two models increased by 28.5%. Looking into Secretlab’s financials reveals clear pandemic lockdown-era reasons for this price increase. As these clear up, prices are likely to stabilize or even fall.

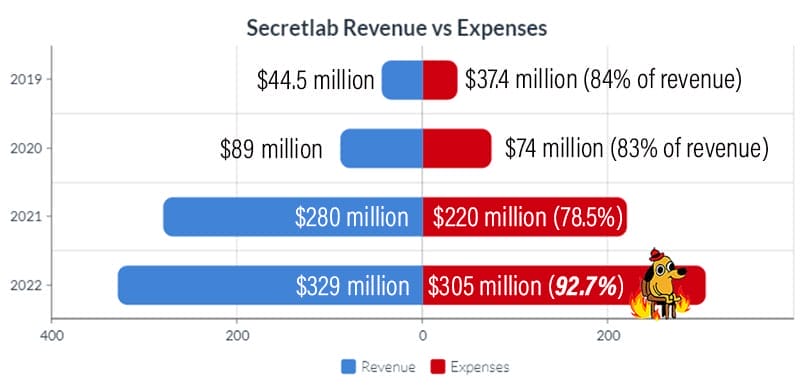

Secretlab Pandemic Sales Strategies

COVID lockdowns began in the U.S. in March 2020. That skyrocketed the demand for Secretlab chairs. As a result, the company has shattered its sales records every year since 2020. However, surging freight costs (749% more than pre-pandemic levels) and materials costs cut deeply into profits.

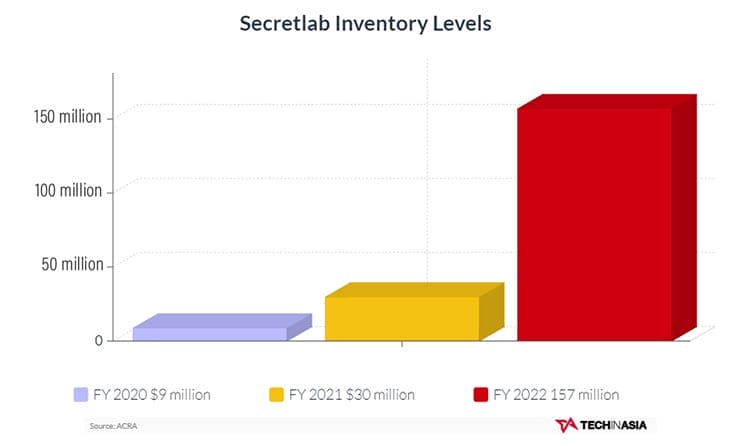

To cope with higher shipping and materials costs, Secretlab ramped up its inventory levels in key markets(2). Its inventory rose from $9 million worth of products to $30 million (a 233% increase) in FYE 2021.

In FYE 2022, inventory reached $157 million (1,644% more than in FYE 2020). An increase in inventory means more money on raw materials and warehousing costs. This reduces net earnings.

Secretlab CEO Ian Ang told Tech In Asia(2) that despite massive sales growth, the 2022 calendar year is likely to be the company’s “first loss-making year”. This impact will mostly be reflected in the company’s FY 2023 financials.

2024 Price Outlook: Stable

In 2023, shipping prices have stabilized. Steel and plastic materials costs are still higher than pre-pandemic rates, but trending downwards. If these patterns continue, Secretlab’s CEO expects a robust return to profitability in 2023.

Aeron Gaming: +24.9% | Embody: +15.6%

Herman Miller acquired Knoll in July 2021 and rebranded itself as MillerKnoll. A year earlier, the company released gaming variants of its iconic office chairs. Since 2021, Aeron gaming chair prices have risen by 24.9%; Embody gaming chair prices are up by 15.6%.

However, unlike privately-owned Secretlab, Herman Miller’s expenses go beyond beyond shipping and materials costs. Specifically, the Knoll acquisition hit the company hard.

According to MillerKnoll’s 2023 Annual Report, the consolidated long-term debt of MillerKnoll (as of June 3, 2023) was $1.37 billion(1). This “increased our indebtedness, which has increased our interest expense…” This may reduce “…our flexibility to respond to changing business and economic conditions.”

Key 2023 Report Findings

- Operating expenses: decreased by $5.2 million (0.4%) versus the prior year. Reductions came from reducing its workforce, and also reducing compensation and benefits for remaining employees.

- Macroeconomic factors: customer demand for high-end furniture is affected by various factors. These include corporate profitability, employment levels, and office vacancy rates. Declines in these measures adversely affects furniture demand.

Price outlook: further prices increases seem likely. The Knoll acquisition came with a $1.37 billion debt burden. But an economic downturn may stifle B2B sales. Growing expenses and shrinking revenue may force the company to raise prices to meet revenue targets.

Steelcase Gesture: 25% discounts

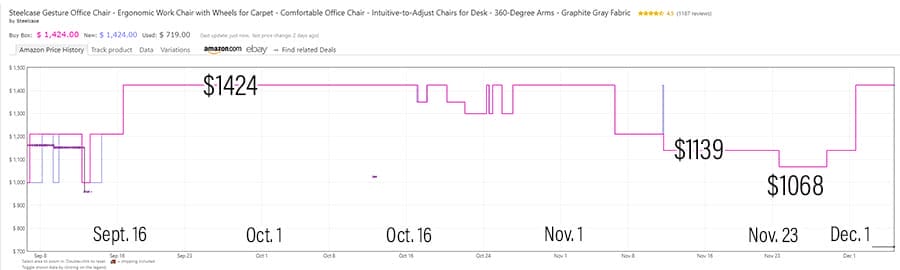

Instead of searching prices on the Wayback Machine, Amazon shoppers can visit keepa.com. There, users can find a 4-month price history for any product on Amazon. For instance, I used Keepa.com to track Steelcase Gesture prices since September.

The graph shows us some fast details:

- Regular price: $1424

- Black Friday price: $1068

- Black Friday discount: 25%

Using this information, buyers can see that Gesture sales prices on Amazon are genuine.

Shipping & Materials Price Trends

Secretlab CEO Ian Ang cited surging freight and materials as the primary reasons for shrinking profits. Here’s an updated look at price trends in these sectors:

Shipping Costs: Falling

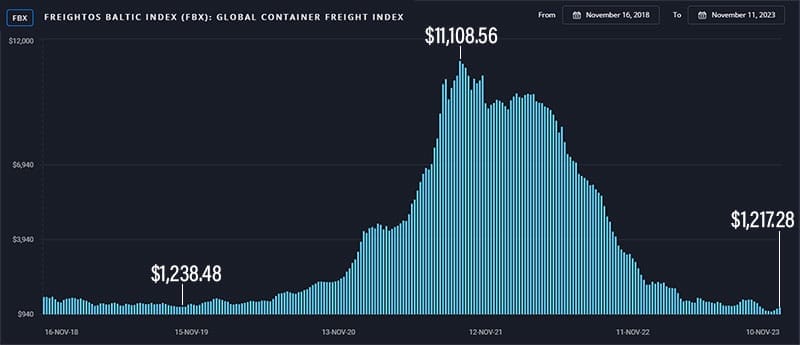

The Freightos Baltic Daily Index measures the daily price of 40-foot shipping containers in 12 major maritime lanes. In pre=-pandemic 2019, the price of a container was $1,238.48. Rates peaked (mid-pandemic) in September 2021, surging 796% to $11,108.56 per container(3).

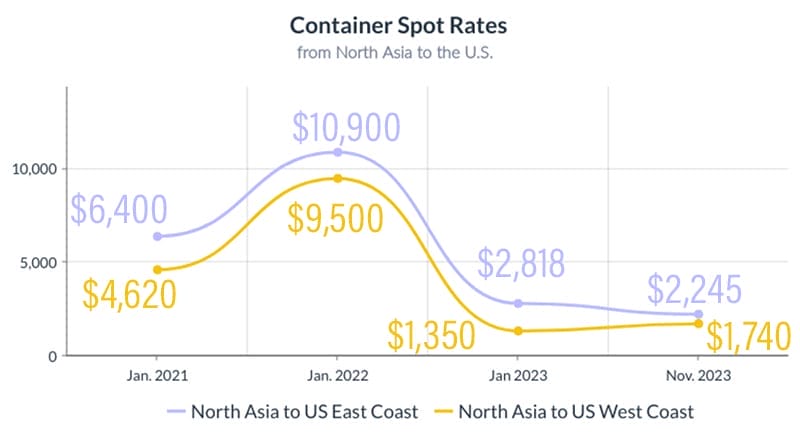

In November 2023, rates normalized to $1,217.28 per container — cheaper than pre-pandemic rates. Notably, the bulk of gaming and office chairs ship from East Asia to the U.S.

S&P’s Journal of Commerce (JOC) reports that trans-Pacific spot rates from East Asia to the U.S. plummeted because of a sharp decline in volume(4).

According to the JOC, falling import demands reflect U.S. financial realities. Tightening consumer credit, inflation, and high mortgage rates are all factors. Versus August 2022, U.S. containerized imports fell by 18.7% in August 2023. The JOC predicts demand will continue to fall through Chinese New Year in February.

Takeaway: as the demand for imported consumer goods shrinks, shipping companies are more likely to lower shipping costs (to compete for business). This negates shipping costs as a gaming chair price factor in 2024.

Materials Costs: Falling

Gaming chairs and ergonomic office chairs are both made with steel, aluminum, and plastic parts. While shipping rates have returned to pre-pandemic levels, materials costs have only partially fallen.

Iron And Steel Rates

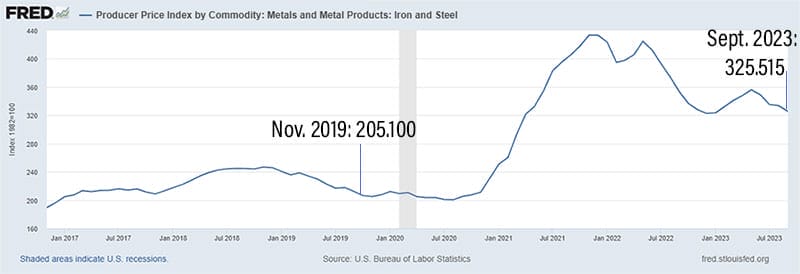

The FRED Producer Price Index (PPI) measures inflation from the supplier’s perspective. The chart below shows an Iron and Steel Index 1982 = 100(5). It expresses price changes relative to the prices in 1982 ( which is assigned a value of 100).

In pre-pandemic November 2019, the rate was 205.100. That means average materials prices increased by 205.1% since 1982. The September 2023 index was 325.515 — a 58% hike over the November 2019 rates.

Plastics Rates

Plastic is used to make caster wheels, armrest parts, control levers, and various other gaming / office chair parts. In July 2019, the plastic & resin index was 272.700 (against a Dec. 1980 Index).

That means July 2019 prices were 272% higher than 1980 prices. In September 2023, the Index reached 322.225 — 18% higher than 2019 rates(6).

Synthetic Fiber Rates

Here’s some bad news for fabric gaming chair fans. These plush, breathable models are upholstered in spun polyester fibers. The bad news is that synthetic fiber textile prices are also rising sharply.

In July 2019, the textile and synthetic fiber index was 131.900 (against a 1982 index). That means July 2019 prices were 131.9% higher than 1982 prices. In September 2023, the Index reached 162.189 — 22.9% higher than 2019 rates(7).

Gaming Chair Price Conditions Recap

Over the past 3 years, Secretlab and Herman Miller chairs have increased by an average of 25%. This coincides with COVID lockdowns, which first hit the U.S. in March 2020. Then, office chair B2B sales flatlined.

In contrast, Secretlab and a few other gaming chair brands broke sales records. But despite more sales, production expenses also increased. Most ergonomic chairs and chair parts are made in China.

The worst pandemic years (2021 and 2022) surged sea shipping rates from China to the U.S by 796%. This, in turn, helped to spike steel, aluminum, and plastic materials costs.

This explains gaming chair price hikes in recent years. From 2021 to 2023, Secretlab Titan Evo prices increased by 27.9%; Herman Miller Aeron gaming chair prices went up by 24.9%.

Pre-pandemic, Secretlab earned around 17% profit per chair(2). In FYE 2023, the company expects to earn a negative profit — despite record-breaking sales levels.

Post-pandemic, shipping prices have normalized, while materials costs are shrinking. Thus, Secretlab expects to resume earning fat profits in the 2024 calendar year. For consumers, this suggests steady prices over the next 12 months.

Herman Miller is an exception. It will enjoy the same normalized shipping and materials costs as other brands. However, its Knoll acquisition continues to weigh the company down. This suggests a high possibility of 2024 Herman Miller price hikes are likely.

Footnotes

- MillerKnoll. ‘2023 Annual Report’. June, 2023. https://materials.proxyvote.com/Approved/600544/20230818/AR_549839/HTML1/default.htm, (accessed 13 November, 2023).

- Simon Huang. ‘Secretlab’s profit declines in FY 2022 as revenue grows’. February 2, 2023. https://www.techinasia.com/secretlabs-profit-declines-fy-2022-revenue-growth-slows, (accessed 11 November, 2023).

- Freightos FBX Terminal. ‘Freightos Baltic Index’. https://app.terminal.freightos.com/fbx, (accessed 11 November, 2023).

- Peter Tirschwell. ‘Ocean carriers survey changing market and ponder next course of action’. S&P Journal Of Commerce, October 12, 2023. https://www.joc.com/article/ocean-carriers-survey-changing-market-and-ponder-next-course-action_20231012.html, (accessed 11 November, 2023).

- FRED Economic Data. ‘Producer Price Index by Commodity: Metals and Metal Products: Iron and Steel’. Updated October 11, 2023. https://fred.stlouisfed.org/series/WPU101, (accessed 11 November, 2023).

- FRED Economic Data. ‘Producer Price Index by Industry: Plastics Material and Resin Manufacturing’. Updated October 11, 2023. https://fred.stlouisfed.org/series/PCU325211325211, (accessed 11 November, 2023).

- FRED Economic Data. ‘Producer Price Index by Commodity: Textile Products and Apparel: Synthetic Fibers’. Updated October 11, 2023. https://fred.stlouisfed.org/series/WPU031, (accessed 11 November, 2023).